Introduction to Economics: Economics was initially presented as a science of state craft. That means it focuses on the connection of government revenue as a whole about government activities.

Origin of the subject of economics was concerned about the relationship between state revenue and the spending the state revenue. Nevertheless, after the industrial revolution, economic growth and trade expanded as well as commerce grew.

Then economic growth becomes the purpose of the government. Therefore a specialized subject area emerged as a political economy after the industrial revolution.

During the 18th century and in the early part of the 19th century, classical economists such as Adam Smith, J.B. Say, and walker define economics as a science of wealth. Adam Smith changed into the pioneer economist who brought the wealth concept.

He is the ”Father of Economics.” His book is ”An Inquiry into the Nature and Causes of the Wealth of Nations” (1776); after that, as time passed, various economists define the subject’s economics base on alternative concepts.

As a result of this, it is possible to identify some other definitions based on welfare contact (Alfred Marshal), scarcity concept (Lionel Robbins), and the growth concept (Poll L. Samuelson). The scarcity concept is widely better than all other definitions.

Definition of Economics

Economics studies the behavior of human beings in the production, exchange, and consumption of goods and services. Accordingly, individuals and their personal needs fulfilled by consuming the products and services for a better life.

Economics is the science of learning how to satisfy unlimited human needs with limited resources. Various economists define the subject of economics based on alternative concepts.

Wealth definition – Adam Smith

Classical economists define economics as the science of wealth. According to them, economics is a science that studied the production, consumption, and distribution of wealth.

Adam Smith gave the name “An Inquiry into the nature and causes of the Wealth of Nations” to his book.

Adam Smith and his followers also accepted this view. J.S. Mill defined economics as ‘the realistic technological know-how of the production and distribution of wealth.

Welfare definition – Neo-classical view

Alfred Marshall introduces this concept in his book ”Principles of Economics.” According to his book, wealth is considered only as a fulfillment of human welfare. So, Welfare is of primary importance to man.

‘Economics is the study of mankind in everyday business life.’

Scarcity definition- Lionel Robbins

According to him, Economics is a science that studies human behavior.

Human behavior is a subject of study about scarce resources and social needs with an alternative use. So, According to this definition, the question of scarcity arises because human resources cannot meet human needs.

Growth definition – P. A. Samuelson

Economics is a study of how men and society choose, with or without money, to employ scarce productive resources which could have alternative uses, to produce multiple commodities over time, and distribute them for consumption now and in future among various people and groups of society.

Let’s analyze the above quote.

- This definition is full of all other meanings.

- It includes whatever Robbins wanted to say.

- Apart from that, it extended to problems of making economic choices under dynamic conditions.

He examines how scarce resources used by society to produce valuable goods. And also how such products and services distributed among different sections of society.

The Modern Definition of Economics

The resources of any economy are limited. The requirements are limitless. Economics is the science of learning how to meet the unlimited needs of those limited resources.

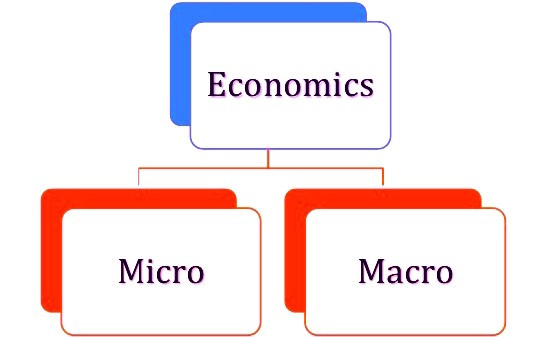

Branches of Economics

There are two major branches of economics.

1. Positive economics

Positive economics is one of the major branches of economics. It offers a goal or scientific explanation of the way the economy is working.

The aim of high-quality economics is how society makes choices approximately. So it could be production, intake, and exchange of products and services, etc.

Therefore, positive economics describes things as what it was, what it is, and what it will be without indicating what is good or bad for the society; hence, it will merely provide the result of an economic analysis of a selected problem.

It can predict what will happen in the future based on the facts, but won’t interpret whether it is good or bad.

For example, The inflation rate in the USA is 0.62% in 2020.

2. Normative economics

Normative economics is the other category of economics. The silence feature of normative economics is, it makes the difference between good or bad.

Normative economics offers prescriptions or recommendations based totally on personal fee judgments.

Therefore for normative economics, prescribe what should be done or what to be happening based on own value judgments to promote human well-being.

For example, The unemployment rate in India is 16%, and it is too high. The government should focus on reducing the inflation rate rather than reducing the unemployment rate.

Economics as a Social Science

Science means a systematized body of knowledge. Such that all the sciences are following a unique method of their inquiry. Scientists are methodically collecting facts. Then analyze them and provide information.

Finally, reach a possible conclusion based on the analysis. Therefore the common characteristics of all the science are that discovering the relationship between cause and effect based on the scientific method.

Any subjects following the scientific method will find the truth, which will fall into the group of scientists. Since the subjects of economics also follow the scientific method to discover the truth. (the relationship between cause and effect) It also falls into the category of science.

Economics is a science, but the degree of perfection is less when compared with the pure sciences.

Introduction to Economics: Types of Economics

There are two main parts of economics.

1. Microeconomics

So what is microeconomics?

Microeconomics is a study of small parts of an economy. It studies the behavior of an individual consumer, firm, household, market, industry, etc., Both product and factor price determination come under the scope of microeconomics.

Thus, it is also called ”Price Theory” Microeconomics covers various issues like demand, supply, production, etc. It helps determine the prices of the product along with the costs of factors of production.

The microeconomics analysis is partial equilibrium analysis because it studies the equilibrium of an individual commodity or factor market. But not over the entire economy.

2. Macroeconomics

So what is macroeconomics?

Macroeconomics is a study of the economic system as a whole. It deals with the study of aggregate national income, total consumption of goods and services, total saving and investment, unemployment, and inflation in the economy.

Since the focus of macroeconomics is on the determination of the aggregate national income of a country and its components, it is called ”Income Theory.”

Introduction to Economics: Methodology in Economics

Economics, as science takes two methods for the discovery of economics laws and principals. The two ways are known as,

- Inductive method

- Deductive method

Therefore economists make theories, laws, and principles by following either approach of inductive and deductive.

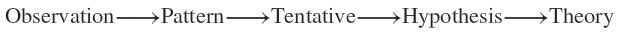

1. Inductive method

The inductive method follows by economists where there is no prior theory. Therefore firstly, we have identified an economic phenomenon to explore.

We could be in a difficult situation due to the unavailability of early theory to get insight into the selected phenomenon. In such a case, we attempt to observe the real world and collect facts and information.

Then we try to identify any possible pattern of the observation. That means whether there any relationships between variables and the nature of the relationships between variables.

After that, we can develop a working hypothesis regarding the behavior of variables. The Select phenomenon connects with it. After that, we test the formulated hypothesis using available and suitable techniques.

If the test proves that the hypothesis is valid, then it becomes a Theory. It’s possible to show how the inductive method is working by a flowchart as follows.

This method is also known as the Bottom-up method.

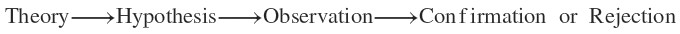

2. Deductive method

This method is also known as Theory Testing Method. This method moves from ‘known to unknown’ or ‘general to specific.’ The order of working of the inductive process of logical reasoning is as follows.

Once we select a particular theory, we can formulate hypotheses based on the theory’s ideas. Hence, this is the first step of the deductive method. The top-down approach is another terminology for the deductive method. This method is useful in analyzing, compress economic phenomena. However, the deductive method is useful only if certain assumptions are valid.

In economics, both deductive and inductive methods used to establish economic theories, principles, and lows. It is known as the scientific method. The main features of the scientific method can describe as below.

- The scientific method depends on real-world facts.

- It explains the relationship between cause and effect based on facts.

- The base of the scientific method is logical reasoning

In conclusion, we can summarize how economics approach the analysis of a particular problem.

- Observe a phenomenon and the problem formulate.

- Develop a theory of model that gets the essence of the phenomenon.

- Test prediction of theory by matching it with real-world economic data.

The Nature of Economic Theory

Economic theories develop to forecasting or explain the behavior of economic phenomena and events. Any explanation of how the given observations are linked together is a “theoretical construction.”

Usually, theories used to “impose order in our observation.” Without those theories, there would be only a meaningless, shapeless mass observation.

Therefore a theory can define in many ways. For example,

- “A theory is organized knowledge.”

- “A theory is a justified truth based on real-world facts,” etc.

Any scientific theory would help us to predict the behavior of unobserved events. Therefore these theories are used in explaining unobserved phenomena. A successful method enables us to predict the behavior of future events.

Introduction to Economics: Components of a theory

A theory consists of a set of definitions. It clearly describes the used variables. Therefore, “variables are the basic elements of a theory.”

- Concept

- Assumption

- Generalization

Any economic theory should go to another important step. Before, it uses as a role in identify real-world phenomena. This step is known as the empirical test. Generally, theories change to be abundant when they are no longer useful.

Process or steps of constructing a theory

- Identify Definitions and assumptions of economic behaviour.

- Process of logical reasoning (developing hypothesis).

- Predictions and indicators of theory.

- Testing of the theory.

Assumptions of economic theory

- Behavioral assumptions – These assumptions are about individual human behavior.

- Institutional assumptions – These are related to social, political, and economic institutions.

- Structural assumptions -These are related to nature, physical structure.

- Ceteris paribus assumptions -Ceteris paribus assumptions simplify reality.

Economics of information

Economics of information is an important branch of economic analysis. Because economic agents (consumers, producers) need complete information to make efficient decisions. That means it is better to have more and accurate information than less to make rational economic decisions.

Nevertheless, some information is costly. (High expensive) According to standard economic theory, all the markets are perfectly competitive. As a result of that maximizes social welfare. Nevertheless, markets are do not lead to efficient solutions in the presence of information problems.

Information problem

The information problem consists of two parts.

- Imperfect information/ incomplete information

- Asymmetric information

Some markets work with imperfect information and asymmetric information. And also, some markets make with imperfect information or asymmetric information.

Imperfect information

Imperfect information makes an absence of specific knowledge of information. They are related to the economic decision.

For example, when a transaction is going to take place, neither party possess full information.

Asymmetric information

Information asymmetric is a difference in access to relevant knowledge. In other words, in asymmetric information, buyers and sellers focus on different transactions or contracts.

The most important characterizes of information asymmetric is it leads to market failures. In this transaction file is reflexes. So the marginal benefit to the buyer or the minimal cost to the seller does not receive. Other results of asymmetric information are

- Shrinking markets.

- They were disappearing in some markets.

- Loss of efficiency.

- There is inefficiency in the allocation of resources.

- Low-quality products can drive high-quality products out of the market.

The asymmetric information problem generates two types of direct outcomes.

- Adverse selection

- Moral hazard

Adverse selection

George Akerlof, in 1970 was the economist who addressed the problem and solutions associated with adverse selection. He called the problem of adverse selection as a lemon problem. Adverse selection may occur when one agent’s decision depends on unobservable characteristics. That adversely affected other agents.

Moral hazard

Moral hazard is when one side receives a worry about a risky event, knowing that it’s far protected against the hazard, and the opposite side will incur the cost. It happens when each event has incomplete information about each other.

Introduction to Economics: Conclusion

This article is an introduction to economics.

In this article, we discuss the definition of economics, branches of economics, economics as social science, types of economics, methodology in economics, the nature of economic theory, and economics of information. Did you find this blog post helpful? If so, who could share it with?

What kinds of content would you like to see more on this blog?

Let me know by leaving a comment below