There are two theories to explain the inflation process. Demand-pull inflation and Cost-push inflation.

- Demand pull inflation

- Cost push inflation

Let us now discuss the theories of inflation.

Demand Pull Inflation | Theories of Inflation

This approach (Demand Pull Inflation) points out the prices of goods and services rise as demand increases relative to supply.

Until the end of World War II, demand push inflation was used to explain inflation in developed countries. Spending more than one’s production capacity causes demand-push inflation.

The meaning of demand inflation is well illustrated by the term ‘a huge amount of money chasing a limited quantity of goods’

There are two alternative approaches to demand inflation.

- Quantity theory of money

- Keynesian approach

The Quantity Theory of Money

In the Quantity theory of money, inflation is explained using the simple exchange equation (MV = PT) popularized by the American economist Arvin Fischer (1867-1947).

In the Quantity theory of money, inflation is explained using the simple exchange equation (MV = PT) popularized by the American economist Arvin Fischer (1867-1947).

- M=Money Supply

- V=Velocity of circulation (the number of time money changes hands)

- P=Average Price Level

- T=Volume of transactions of goods and services

If this equation V and T remain constant, then there is a directly proportional relationship between the money supply (M) and the price level (P).

Example

Money supply (M) = 3000 $

Velocity of circulation (V) = 15

Average Price Level (P) = 6

Volume of transactions of goods and services (T) = 7500

If the money supply increased from $ 3000 to $ 6000, the price level would change accordingly.

MV = PT

6000 x 15 = 12 x 75000

In the example above, when the money supply doubles from $ 3000 to $ 6000, the price level doubles from $ 6 to $ 12.

The quantity theory of money reveals a very important truth. That is, if a state expands its money supply to cover its spending, the end result will be rapid inflation.

Examples: During the First World War, Germany printed large sums of money (by expanding money) to cover its war expenses. The end result was a sharp rise in inflation in Germany.

In the 1960s, the quantity theory of money was presented in a more advanced form. It was based on the ideas of Milton Friedman. He is a professor at the University of Chicago in the United States. He was also the recipient of the 1976 Nobel Prize in Economics. Milton Friedman’s view was that there was a constant demand for money. Accordingly, he was of the opinion that inflation is a financial phenomenon at all times and everywhere.

Keynesian approach

Keynesian approach to demand inflation is based on Keynes’ overall expense-income specification on income determination.

The Keynesian approach points out that there is a gap in inflation in the economy as overall spending continues to rise once the economy reaches full employment equilibrium.

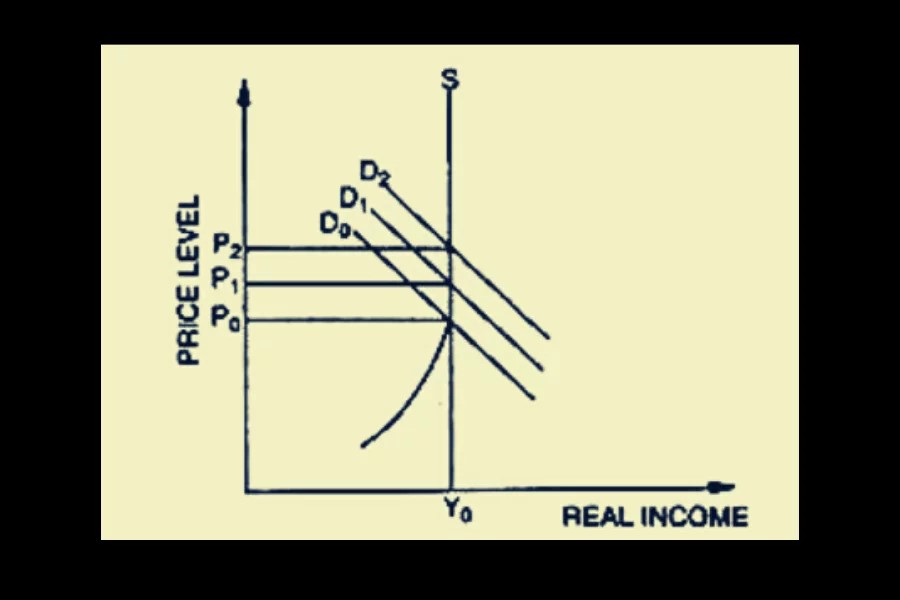

This theory shows that when supply is stable, commodity prices rise. Once the economy reaches full employment, the manufacturer fails to increase production further. But in this case, the price level rises as demand continues to expand. This is shown in the figure below.

Further expansion of the demand curve will only increase the price level to P2 and P3. Production does not increase.

According to the Keynesian approach, there are several factors that contribute to this increase in demand.

- Consumption cost

- Investment cost

- Government Expenditure

Cost Push Inflation | Theories of Inflation

As a result of input prices rise, production costs increase. Therefore, commodity prices rise and inflation occurs. This is what the theory shows.

This theory shows that as a result of the struggle between oppressed groups to demand a share of the national income, prices are pushing up. There are two main groups of oppressed.

- Organized labor

- The activism of the oligopoly

Organized labor means trade unions. As they work to raise their wages, production costs rise, overall supply falls, and prices rise. This is called wage-driven inflation.

An oligopoly is a market structure with a small number of firms, that control the market. Examples: Gas companies, commercial banks.

These firms reduce supply and increase prices to increase their profits. Thus the price of goods is not determined by market forces but by the outcome of an administrative process. This is called profit-push inflation.

These firms reduce supply and increase prices to increase their profits. Thus the price of goods is not determined by market forces but by the outcome of an administrative process. This is called profit-push inflation.

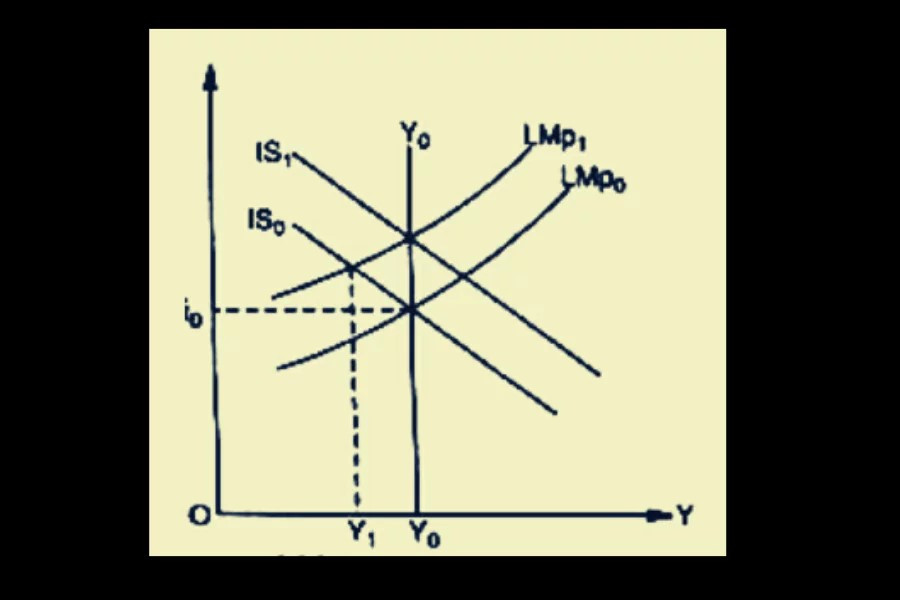

Cost push inflation is caused by rising production costs, declining market supply, and rising commodity prices. It can be seen in the diagram below.

According to the figure, the price level rises from P1 to P3 as the aggregate supply continues to increase.

Another variant of cost-push inflation is called the supply shock. Unexpected increases in raw materials or energy inputs (eg petroleum, coal, etc.) may increase the cost of production and result in higher commodity prices and inflation.

Many supply shocks have contributed to cost-push inflation since the 1970s. The sharp rise in oil prices has increased the cost of production and transportation of every product in the oil-importing countries. As a result, cost push inflation accelerated.

A full understanding of theories of inflation is simply discussed in this article. Leave your comments below.

Theory of Production: short-run, Long-run

Production Function: 3 Types of Production Function