Decision making is not an easy task under risk and uncertainty. To make an effective decision, we should have enough knowledge about risk and uncertainty and the relationship between the two.

Risk, certainty and uncertainty can be identified in a simple manner as follows.

Concept of Certainty

Certainty means a decision can be taken with full knowledge about the situation. It means to have complete information about future conditions.

Example of certainty

Considering a simple example, every farmer has knowledge of the time periods for growing crops. Therefore, they make definite decisions within the relevant time frame. That is, they have prior knowledge of the decision they make.

Concept of Risk

In a simple manner, the risk is an action or choice that can result in a losing situation and It could be emotional, monetary or otherwise.

As well as risk can be measured and outcome is known. Someone make a decision and he or she knows the outcome of the decision and it could be loss or not.

Example of risk

Considering a simple example, a man lost his job and is unable to pay his rent. Because of this, he makes the choice to steal money from the local convenience store. In this situation, the man gets a risk and he knows the outcome is bad.

Concept of Uncertainty

Uncertainty means that implies a situation where future events are not known and can not be measured. It means outcome of the decision is unknown and uncontrollable.

Example of uncertainty

If we concern this concept within a simple example when a consumer buys goods, they know what they are getting and how much utility they get from their consumption but for some goods, it means games or lotteries outcome is uncertain. Horse racing, buying insurance, playing gambles, outcome cannot be measured certainly.

We got some knowledge about certainty, risk and uncertainty. How decision-makers take an effective decision under these three concepts can be identified as follows.

Decision making under certainty

In this situation decision maker has complete knowledge of the outcome. In such a case he would select a decision alternative that will yield the maximum payoff under the known state of nature.

Considering a simple example for decision making under certainty can be identified as follows.

Examples of decision making under certainty

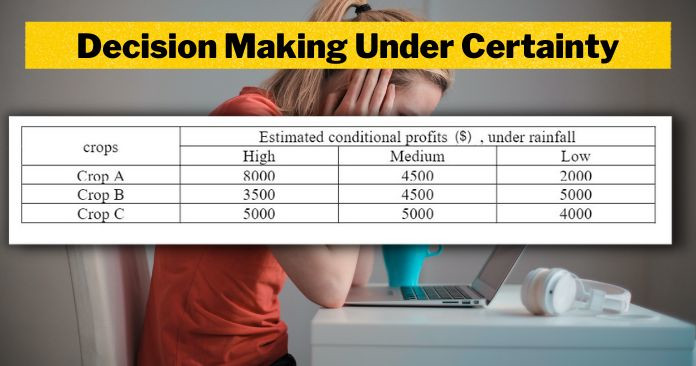

For example; a farmer wants to decide which crop should plant among three crops, on his 100-acre farm.

The payoff from each is dependent on the rainfall during the growing seasons. The farmer has categorized the amount of rainfall. It was high rainfall, medium rainfall and low rainfall. his estimated profit for each is given in the table below.

Considering the above information, the farmer decided which crop should be planted under the amount of rainfall as high, medium and low.

- When the rainfall is high, the farmer decided to plant crop A because Crop A profit is higher than others under the amount of rainfall as high.

- When the rainfall is medium, the farmer decided to plant crop C because crop C is higher than others under the amount of rainfall as the medium.

- When the rainfall is low, the farmer decided to plant crop B because crop B profit is 5000. It is higher than others.

According to this situation decision maker has complete knowledge about outcome therefore he could be able to take an effective decision with maximum payoff.

Decision making under risk

In economics, to make the best decision we have to measure the risk first. In order to measure the risk, there are two measurements as follows.

- Expected value

- Variability

Probability is a very essential concept to calculate these two. If there is more than one possible outcome of a decision and the probability of each outcome can be estimated.

Therefore, we need to know the probability of each possible outcome of a decision to measure the degree of risk. There are two main concepts of probability. They are,

- subjective probability

- objective probability

- In subjective probability, decision-makers have knowledge about past information or data is available regarding the occurrence of outcomes.

- In objective probability, there is no similar past experience that helps us in measuring probability. It is based on decision makers’ personal judgment, experience or knowledge about the subject.

Whatever the way the probability is decided, by past experience or by individual perception, probability helps to measure two concepts expected value and variability.

Considering the example for this concept we can identify how decision-makers take an effective decision with a risk.

Examples of decision making under risk

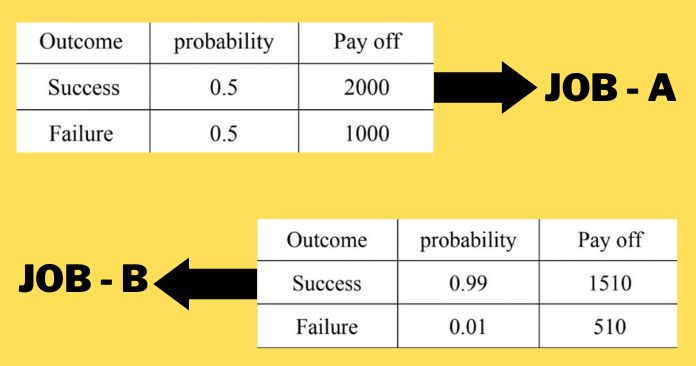

There are two jobs, job A and job B. Expected income of both jobs are similar as $1500. The probabilities of two outcomes, it means succeeding the company and failure of the company can be stated as follows.

JOB – A & JOB – B

We cannot get the best decision considering the above information only, we have to count the expected values of these two jobs for identify, what is the high riskiness decision is?

Expected value

EV of Job A= (0.5* 2000) + (0.5* 1000) = 1500

EV of Job B= (0.99*1510) + (0.01* 510) = 1500

As cleared above we cannot make a decision regarding the best job by looking at their expected values because expected values are similar.

So, we have to find out their variability and for that, we should calculate the standard deviation.

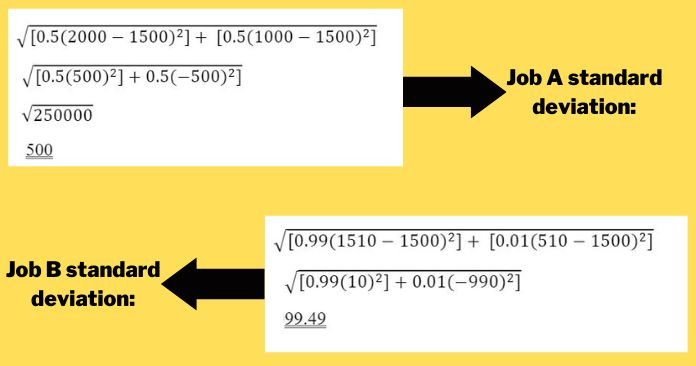

Variability

Job A and B standard deviation:

According to the above calculations, it is clear that the standard deviation of Job A is greater than Job B. That means the riskiness of Job A is higher than Job B.

In statistically, we can find a risk of the decision as above mentioned. The probability of outcomes, expected values and variations need to know to make an effective decision.

Decision making under uncertainty

As we know, under uncertainty decision-maker cannot be measured the outcome of the decision, and no measurable probability of the outcome. If the availability of information for the decision enrollment is incomplete.

There are five criteria that come under decision making under uncertainty. They are,

- Maximin criteria

- Maximax criteria

- Hurwicz alpha criteria

- Minimax regret criteria

- Laplace criteria and maximization of expected value

A decision-maker doesn’t have any idea about what will occur or what is the chance of a particular event occurring because of this, he is faced with a situation of total uncertainty.

Therefore, taking the best decision under uncertainty we have to follow these criteria. Let’s consider an example.

Examples of decision making under uncertainty

There is a newspaper boy and he is thinking of selling, a special one-time edition of a sports magazine to his regular newspaper customers. Based on his knowledge of his customer, he believes that he can sell between 9 to 12 copies.

The magazines can be purchased at 8$ each and can be sold for 12$ each. Magazines that are not sold can be returned to the publisher for a refund of 50%.

If he sells a magazine, he gets four rupees as a profit. If he is unable to sell a magazine he can return it to the publisher but he loss 50% purchasing price. It means he is losing four dollars.

He thinks that the demand can be either 9 or 10 or 11 or 12 copies. So, in other terms basically, we have four states of nature that are

N1is equal to 9

N2 equal to 10

N3 equal to 11

N4 equal to 12

In order to this demand which is varying between 9 to 12, the newspaper boy has four options or four strategies that he can adopt that is either he can buy 9 magazines 10 or 11 or 12.

Strategies are shown as

S1=9

S2=10

S3=11

S4=12

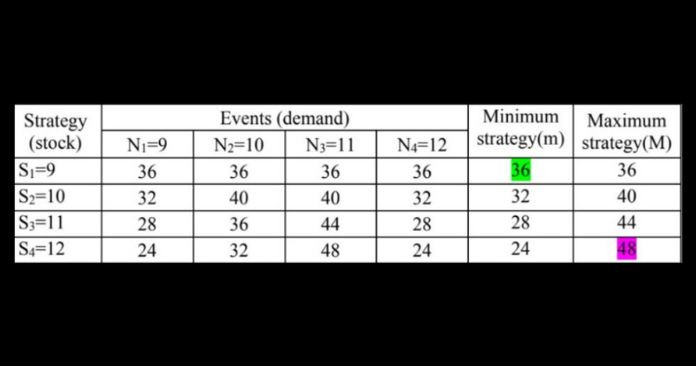

Pay off metric is given below regarding the above information.

According to the payoff metrics, the above criteria can be calculated as follows.

1. Maximin criteria

The maximin criteria is called the criterion of pessimism. This implies that the worst possible outcomes for each action. The decision-maker should choose the best of the worst by selecting minimum payoff considering the above metrics.

Considering the above table, 36 is the maximin value, so choose strategy S1. It means that he is selling 9 newspaper. This action maximizes the minimum payoff. This decision is well-suited to firms whose very survival is at stake because of losses.

2. Maximax criteria

The Maximax criteria is known as the criteria of optimism. These criteria are well-suited to those who are extreme risk-takers. This also implies that the ‘best of the best’ decision.

In our example best of the best decision is strategy S4. because the maximum value is 48. It means that Selling 12 newspapers gives maximum payoff.

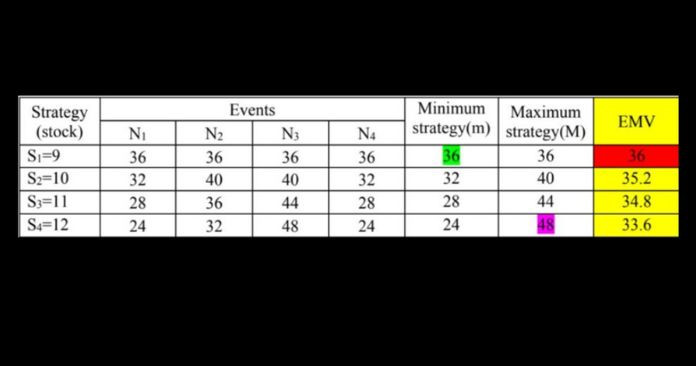

3. Hurwicz alpha criteria

In these criteria, we have to find out the expected monetary value for each of the strategies.

In this example alpha= 0.4 and the calculating formula is,

α * maximum payoff(M) + (1- α) * minimum payoff(m)

After Calculating, EMV (expected monetary value) can be stated as follows.

Based on the EMV, strategy S1 has the highest value of EMV. So, our optimal strategy will be to choose S1 that is by nine magazines.

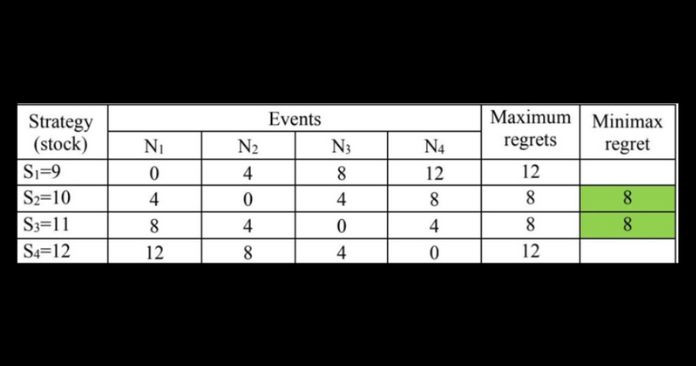

4. Minimax regret criteria

These criteria suggest that the decision-maker should attempt to minimize his maximum regret. Regret represents an opportunity lost so for each of the demands.

If we did not choose the best strategy then how much would be the regret or opportunity lost for all the other strategies. for that particular event or demand that is the regret. so once we calculate all the regrets what these criteria say is to find the maximum of the regrets.

So, find the maximum of the regrets for each of the strategies and then find the strategy which has the minimum of all the maximum regrets so then the second is to find the minimum amongst those regrets.

Basically, we want to minimize the regret and find the one which is the minimum because that then will be the best strategy.

So, minimax so out of these 8 is the minimum and it is the regret for both S2 and S3. So, the optimal strategy as per the Maximax regrets criteria is that we can choose S2 or S3.

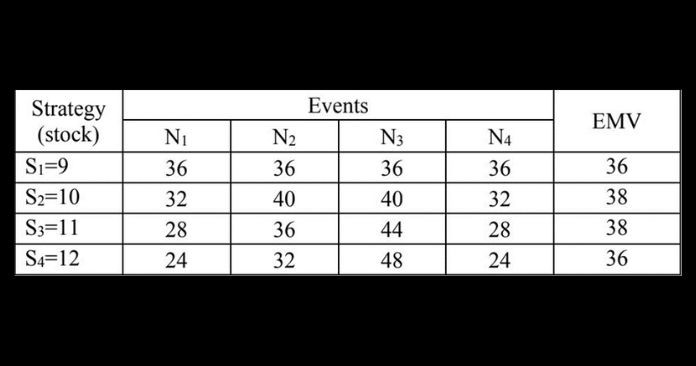

5. Laplace criteria

Laplace criteria suggest that if we do not know of any reason for one event to occur more than the other, we should assume that all events have an equal chance of occurrence.

In this criterion, we assign the same probability to each of the events. That is we assume that each event is equal- probable.

Here there are four events and each has to assume an equal probability of occurrence the probability of each event to occur is one -fourth.

So, each strategy should calculate a monetary value which is nothing but the addition of the products of the probability with the payoffs so for s1 the EMV will be one -fourth multiplied by 36 plus.

Maximum EMV is obtained by strategies S2 and S3 so based on Laplace criteria again decision could be either choose S2 or S3.

According to the above-mentioned information we can get an idea about the nature of the various criteria and effectiveness for making a decision under uncertainty.

Decision making under certainty, risk and uncertainty can be identified clearly using the above examples and also decision-makers can get a brief and effective knowledge about decision making.

All right then. I really hope you enjoyed this article.

Have you a question about something that I covered.

Either way, I’d like to hear from you. So go ahead and leave a comment below.