Let’s identify the oligarchy before identifying the characteristics of an oligopoly.

An oligopoly is an industry dominated by a few large firms (Few sellers supplying, many buyers). These firms are large enough that their quantity influences the price and so impacts their rivals.

Consequently, each firm must condition its behavior on the behavior of the other firms. The most important model of oligopoly is the Cournot model or the model of quantity competition.

Characteristics of the oligopoly

1. Few Sellers and Many Buyers

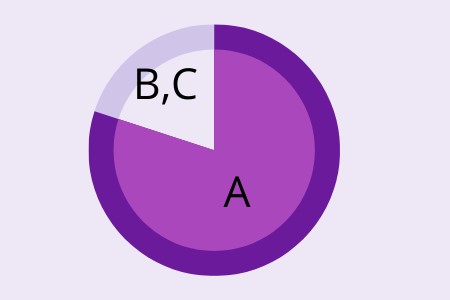

- There are few firms.

- Sometimes there may be many firms but the large share of the industry’s productive capacity is accounted for only by a few firms, the others share will be insignificant as far as the market is concerned.

- When there are two firms, the market structure is called duopoly

- The number of buyers will be quite large as in other market models

2. Homogeneous or Differentiated Products

- Products may be either homogeneous or differentiated.

- If the products of all firms are homogeneous, then it is called ‘pure oligopoly’

- If the products are differentiated, then it is called ‘differentiated oligopoly’.

- The nature of products of the firms is crucial in making price and output decisions

3. Restricted Entry

- Entry into the industry is legally free.

- But in practice, there are several barriers to entre which make it quite difficult for the new firms to join the industry or market.

Natural entry barriers

- Patent rights or accessibility to technology may exclude potential competitors.

- The need to spend a huge amount of money on name recognition and market reputation may discourage entry by new firms.

- Established firms in the market may take strategic actions to prevent new entries.

- For example, the existing firms might threaten to reduce the price drastically if entry occurs.

4. There is Perfect Knowledge or Information about the Market

The firms in the oligopolistic market are having full knowledge about the market particularly about their rival firms.

5. Mutual-interdependency

- Mutual interdependence among the firms in decision making is the essential feature of the oligopolistic market.

- Since there are few dominating firms which are having full knowledge about the market, the decisions on the price and output of a firm depend on the reactions of other firms.

- This was not happened either in perfect competition or in monopolistic competition.

- Any decision taken by a firm in order to increase its sales would adversely affect the sales and hence profit of the other firms. Therefore, necessarily they tend to react.

Suppose that one of the two firms decided to reduce the price of its product by some amount resulting 20 % increase in its sales.

Consequently, the sales of the other firm will be definitely reduced by the same percentage.

Hence, undoubtedly it will react to the price reduction decision.

Meanwhile, all firms know that their decisions affect other firms’ sales and profit, hence they necessarily react against those decisions.

Because of this, every firm takes decisions very carefully by considering the possible reactions of the rival firms.

Factors that the Degree of Interdependency among Firms depends on

1. Greater the number of firms, the higher the degree of interdependence.

2. The size distribution of the firms

Consider a simple case of three firm oligopoly. If one firm is large enough to account, which is that 80% of sales in the industry. The other two share the rest (20%). Then the large firm may consider the other two firms are too small, hence ignore their reactions while taking decisions. That is, the large firm acts independently. But the other firms act considering the interdependence. So here we can see a one-way interdependence pattern.

3. The nature of the products

If the products of the firms are homogeneous then the interdependence will tend to be strong because of the perfect substitutability of the products of the firms.

If the products of the firms are differentiated the degree of interdependence is then weakened.

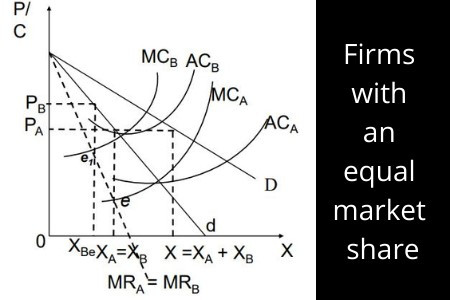

Low-cost Price Leadership – Firms with an equal market share

The market has been shared equally by firms A and B

The cost of firm A is lower than firm B

Profit maximizing the output of firms A is XA and the price is PA

Firm B adopts this price and sells XB(=XA) amount.

However, at this price profit of firm B is not maximized.

The profit-maximizing price of firm B isPB (>PA) and the quantity is Xbe (<XB)

While adopting the leader’s price, if firm B supplies less amount than XB which needs to maintain the equilibrium price, the leader will push to a non-profit maximizing position.

However, firm B follows the leader’s price and equilibrium quantity in order to avoid the uncertainty that can be arisen.

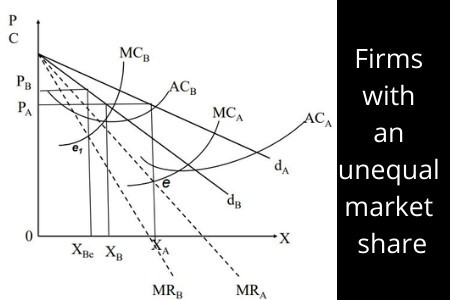

Low-cost Price Leadership – Firms with an unequal market share

The market share of the firms is unequal.

Cost of firm A is lower than firm B Profit maximizing price and quantity of firm A is PA and XA respectively

Firm B adopts this price and sells XB(<XA) amount.

The profit-maximizing price of firm B is PB(>PA) and the quantity is Xbe.

However, firm B will follow the leader’s price and equilibrium quantity in order to avoid the uncertainty that can be arisen.

Is Microsoft an oligopoly 😯 Do you want to know Click Here

All right then. I really hope you learned this article.

Have you a question about something that I covered.

Either way, I’d like to hear from you. So go ahead and leave a comment below.

To further understand market modules follow the below topics.

Short run equilibrium in monopoly

Perfect Competition: Definition, Graphs, short run, long run

Top 5 characteristics of an oligopoly

Monopoly – Price discrimination: Types, Degrees, Graphs, Examples

Different Types of Monopolies| 7 Types

Monopolistic competition assumptions

Monopolistic Competition Equilibrium| Long-run| Short-run

Monopolistic Competition and Economic Efficiency