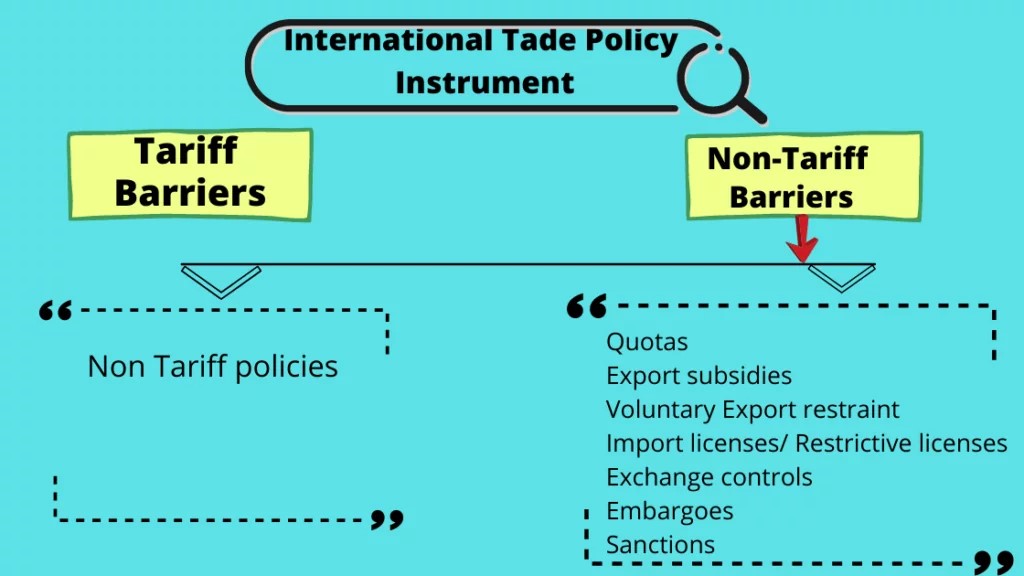

Many governments follow various types of non-tariff barriers (NTBs) as instruments of trade policy. It includes import quotas, export subsidies, voluntary export restraints, import licenses/ restrictive licenses, exchange controls, embargoes, and sanctions.

Non-Tariff Barriers 1. Quotas

Quotas are government-mandated limitation on either quantity or the value of trade in a product. The limitation is enforced issuing licenses to some group of individual or firms.

For instance, USA has a quota system on cheese and only certain firms that allocated licenses were allowed to import cheese. In some cases notably for apparel, licenses were given directly to the governments of exporting countries.

Since quotas are viewed as being more restrictive than tariffs; quotas on many manufactured products have been prohibited by the WTO.

As part of Uruguay round agreements (1994), signatory countries have begun to replace existing quotas on agricultural products, textiles and apparel with tariff or tariff rate quotas (TRQs).

TRQs are quota policies that allow a certain quantity of good into a country at low tariff rates, but then apply a higher tariff to quantities that exceeds the quota.

Like all other trade barriers quota also reduce world trade efficiency and invite retaliatory actions. Quotas are much greater threat to competition than tariff, because quotas preclude additional imports at any price].

The past experience of the United States on sugar quota indicates that it is a system of protecting a small group of producers, each of whom receives a large benefit at the expense of a large number of consumers (Krugman, 2000).

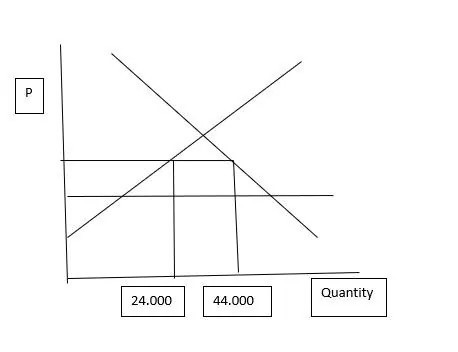

According to Ingram and Dunn (1993), the allocation of quotas can be a source of bribery if importers offer money to government officials for receiving rights. They also emphasized that quota could create a problem of legal evasion. Figure 1 shows the cost benefit effects of imposing a quota.

Figure 1: Welfare Effects of a Quota

Non-Tariff Barriers 2. Voluntary export restraint (VER)

A variant of quota system is known as voluntary export restraint (VER) agreement negotiated with a foreign supplier.

Under the VER arrangement, the importing country does not maintain a limit on the amount to be imported, but exporting countries voluntary limit the volume being sent out as agreed.

In return, these foreign industries are able to raise their prices by earning the quota rent on top of their normal profits.

Though it is believed that quota limits imports without raising domestic prices, quota always raises the domestic price of the imported goods due to demand for the goods exceed the domestic supply and limited imports.

Non-Tariff Barriers 3. Export Subsidies

An export subsidy is a payment to a firm or individual that ships a good abroad. Like a tariff, an export subsidy can be either specific (a fixed sum per unit) or ad valoram (a proportion of the value exported).

When the government offers an export subsidy, shippers will export the goods up to the point where the domestic price exceeds the foreign price by the subsidy.

Export subsidies were viewed as an unfair competitive tool and, as a result, many countries imposed countervailing duties (a tariff imposed by an importing country designed to offset artificially low prices charged by exporters) on such exports. The WTO was taken action to outlaw export subsidies on manufactured goods.

Non-Tariff Barriers 4. Import licenses/ Restrictive licenses

Countries can use licenses to restrict imported goods to specific businesses. If a business is given a trade license, it is allowed to import goods that can be restricted to trade in the country.

For example, cheese and cheese products in Washington are subject to the requirements of the Department of Food and Administration and the Department of Agriculture, and most imports of cheese require an import license and are subject to the quotas governed by them.

Non-Tariff Barriers 5. Exchange Controls

Exchange controls are the restrictions imposed by the government on buying and/or selling money. These controls allow countries to better stabilize their economies by limiting the inflows and outflows that can cause exchange rate volatility.

Non-Tariff Barriers 6. Embargoes

Imposes embargoes to restrict trade in specific goods and services. An embargo is a measure a government will use for specific political or economic circumstances.

Non-Tariff Barriers 7. Sanctions

Countries impose sanctions on other countries to limit their trade activity. Sanctions can include trade procedures and increased administrative actions or additional customs. Trade procedures can slow or limit a country’s ability to trade.

I think you learned about types of non-tariff barriers (NTBs) clearly.

Also, you can refer to the following articles.

International trade microeconomics

Classical International Trade Theory | absolute advantage

What is comparative advantage?

International Trade and Economic Development