Classical thoughts of international trade include,

Absolute advantage theory – Adam Smith

Comparative advantage theory – David Ricardo

It is more effective to understand the fundamentals of absolute advantage theory before identifying what a comparative advantage theory is.

Classical International Trade Theory | absolute advantage

Let’s start. What is the comparative advantage?

The Principle of Comparative Advantage

Considering the limitations of the absolute advantage theory, the theory of comparative advantage was presented by David Ricardo (1819). Though there is substantial evidence that to prove the original idea was developed by Robert Torrents in 1808, it was presented by Ricardo through his famous book on the principles of political economy in 1819 (Husted and Melvin, 2002).

The theory is known as the main principle of international trade that explains the mutually beneficial trading relationship between countries.

Ricardo showed that mutually beneficial trade can occur even at the situation of one nation have absolute advantage for producing two goods.

Ricardo’s analysis is also based on the supply conditions of the market. The theory was based on the principle of comparative advantage that determine on relative cost differences in countries, occurred from the availability of natural resources or the acquired (manmade) advantages.

Natural advantages refer to natural resources such as land, mineral, soil, forest and animals and acquired or manmade advantage refer to skills and abilities acquired through human resources (Carbough, 2005). The table 1.1 shows how determine natural or acquired resources among nations.

Table 1.1: Natural and Acquired Advantages According to Countries

| Natural Resources | Country | Acquired Resources | Country |

| Oil | Middle East | Textile | China, India |

| Wheat | USA, Canada | Automobiles | USA, Japan |

| Aluminum Ore | Jamaica | Jetlines | USA, France |

According to the principle of comparative advantage, countries should specialize products which they have the greatest absolute advantage (if they have the absolute advantage for both goods) or the least absolute disadvantage (if the country has an absolute advantage for neither goods).

Thus a country has a comparative advantage in a good if the product has a lower pre-trade relative price than it found it elsewhere in the world.

Thus even if a nation has an absolute cost advantage for producing both goods, mutually beneficial trade may still happen by producing the least cost product or the least disadvantage product ( Husted and Melvin, 2002).

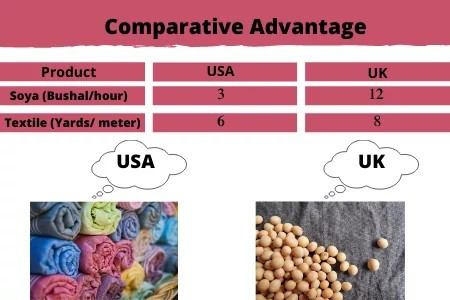

Table 1.2: Determine the Comparative Advantage

| Product | USA | UK |

| Soya (Bushal/hour) | 3 | 12 |

| Textile (Yards/ meter) | 6 | 8 |

The table 1.2 shows how international trade is occurred according to the principle of comparative advantage.

According to the table 1.2 USA has the absolute advantage for producing both goods. It requires 3 hours to produce 1 unit of soya and 6 hours to make one meter of textile while UK requires 12 and 8 hours to produce the same quantities.

The table further shows that USA is efficient four times (12/3=4) than UK in producing Soya but efficient only 4/3 (8/6=4/3) times in making textiles.

When considering the relative cost differences in the two countries, the USA has the greatest absolute advantage for producing soya and the UK has the relative least absolute disadvantage for making textile.

Thus the USA has a comparative advantage for producing soya and UK has a comparative advantage for making textiles.

Once the trade is allowed between two countries each should move to specialize the production of goods which they have a comparative advantage and export the excess supply to other country for exchange of good which they do not have the comparative advantage.

Accordingly both countries will get mutual benefit from trade. This process will lead to increase in world production of both goods (see table 1.3).

Table 1.3: Gains from Specialization According to Comparative Advantage

| Country | Gain from Soya | Gain From textiles |

| In USA | +2 | -1 |

| In UK | -1 | +1.5 |

| In World | +1 | +0.5 |

According to table 1.3, if the USA reduces textile production by 1 unit, it frees 6 hours of labor to the soya industry enabling to increase soya production by 2 units (6/3=2).

Similarly, if the UK reduces 1 unit of soya it will release 12 labor hours that could use for textile and increase the production by 1.5 (12/8 = 1.5).

Thus world production is also increased by 1 unit of soya and 0.5 units of textiles.

Comparative Advantage in Money Terms

The principle of comparative advantage could be measured in terms of financial values used by countries. Thus considering the wage levels and the exchange rates of respective countries, values of comparative advantage is estimated as follows (table 1.4).

Thus laborers in USA is paid in dollars and laborers in UK is paid in pounds. If a labor in USA is paid $ 20 per one hour and a British labor is paid L 5 per one hour, prices of Soya and textiles could calculate by dividing production by wage rates Accordingly unit price of each commodity in USA and UK could calculated.

Since the two countries are used different currencies, it is necessary to convert to one currency as shown in table 1.4. If the dollar pound conversion ratio is US$1.60 = starling L 1, prices in two countries are presented in the same currency (dollar).

Accordingly, the USA could produce soya at a lower cost than the UK. While the UK is more efficient in making textile at a lower cost than Consequently, the USA has the comparative advantage for soya and UK has the comparative advantage for textiles.

Table 1.4: Comparative Advantage in Money values

| Country | Labor input | Wage Rate ($/h) | Soya (Bushel) | Price/ soya | Textile (Meters) | Price/ Textile |

| USA | 1 hour | $20 | 40 | $0.50 | 40 | $0.50 |

| UK | 1 hour | L5 | 10 | L0.50 | 20 | L0.25 |

| Converted value UK | 1 hour | $8 | 10 | $0.80 | 20 | $0.40 |

($ 1.60=L 1)

The Opportunity Cost and Comparative Advantage

Though the theory of comparative advantage provides sufficient knowledge to understand how to determine trade among the countries, the methodology was not sound to explain how the value of trade determined in each country.

Hence, the opportunity cost theory was introduced by Godfried Haberler in 1936. The theory is referred as the low of comparative cost.

According to opportunity cost theory, the opportunity cost is estimated on counting forgone cost that must be given up to release enough resources to produce one additional unit of the second product.

No assumption has made here that labor is the only factor of production or it is homogeneous. It is also assumed that the price of the commodity is not exclusively dependent on labor. Thus, a country which has the low opportunity cost for producing a good compared to other country, it has the comparative advantage for producing respective goods and comparative disadvantage for producing the second good.

Opportunity cost theory will be discussed in another article.

Hope you enjoyed this article.

Have you a question about something that I covered.

Either way, I’d like to hear from you. So go ahead and leave a comment below.