Monopoly – Price discrimination: A monopoly firm being the only one seller in the market is free to charge different prices from different buyers when the prevailing conditions are appropriate for this pricing policy. If the firm follows such policy in practice we call it price discrimination.

There are 3 types of price discrimination.

- First-degree price discrimination

- Second-degree price discrimination

- Third-degree price discrimination

How does price discrimination benefit monopolies?

Instead of selling all output at a single price, the monopoly firm charges a higher price than the equilibrium price for a part of its output and thus increases its revenue.

Since under price discrimination the firm charges different prices for the same product which produced/provide by the firm itself, the cost of production does not change market to market.

Because of this, the firm can earn a higher profit than selling all output at a single price. In practice, there may be slight differences of the products.

Which is the best example of price discrimination?

For example, different prices for the different classes in an aircraft and a train, different seats in a cinema hall) as well as costs of production but not as much as the difference in the charged price.

What are the factors that affect monopoly price discrimination?

In fact, the prices that the monopoly firm can charge from different buyers depend on certain factors such as the preference of the buyers, their income, their location, and the ease of availability of substitutes.

Because of the differences of these factors, the price elasticity of different buyers would be different as such the shape of demand curves also would differ among different buyers/markets.

What are the conditions of price discrimination?

Even to the monopolist in order to implement this price discrimination policy, two necessary conditions must be satisfied.

- The market for the products of a monopoly company should be divided into sub-markets with different price elasticities.

- Those sub-markets must be effectively segregated. There should be no resale from the low price market to the high price market.

If there is a possibility for reselling, speculators will buy the product from the low-price market and will sell in the high price market. Then the price discrimination will unsuccessful.

What are the elements of market segmentation?

- Nature of the product

- Geographical location of the market

- Certain attributes of the buyers

- Basis of time

What is market segmentation with example?

In fact, market segmentation depends on certain factors

- Nature of the product

For example, a doctor can apply this price policy since he provides his service customers one by one and his service cannot resale. This implies that in the case of services such as electricity, gas, saloon, water supply, telephone services cannot be resale and hence apply price discrimination policy.

2. Geographical location of the market

For example, the firm that provides a certain commodity for the foreign market and domestic market can practice this policy very easily since the reselling within these markets is costly.

3. Certain attributes of the buyers

For example, age may be a separate device in a film theater, railway, etc. Lower prices are charged for children for these services.

4. Market segmentation can be done on the basis of time

For example, the price of a dinner may be higher than lunch in a five-star hotel; fresh fruits/vegetables may have higher prices than old stocks.

In addition to these factors, there may be several other factors that affect the market segmentation.

The only thing that should be understood is that monopoly firms can separate their market and sell their output at different prices.

What are the 3 types of price discrimination| Graphs

Depending on the extent of price discrimination economists classify it into three types: First degree, Second degree and Third degree price discrimination.

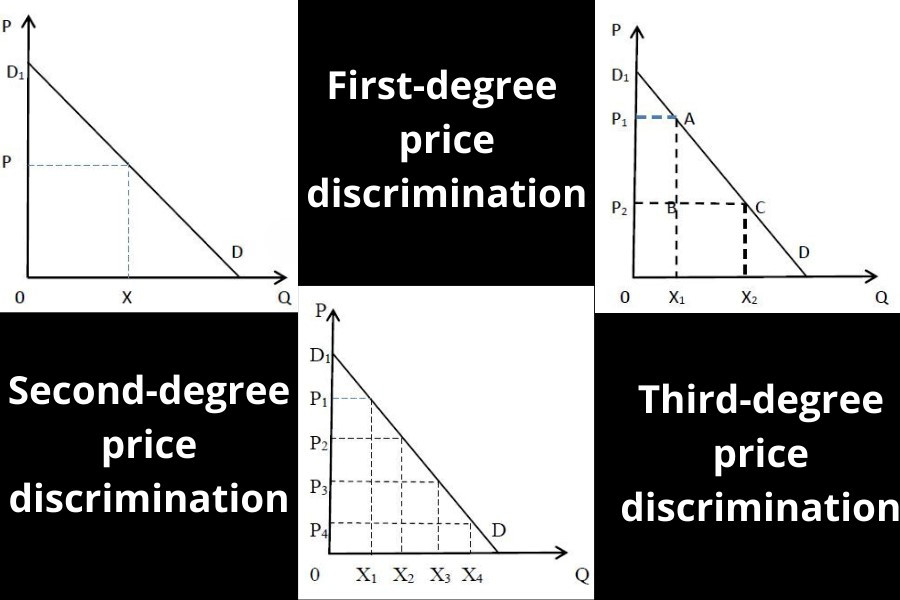

First-degree price discrimination

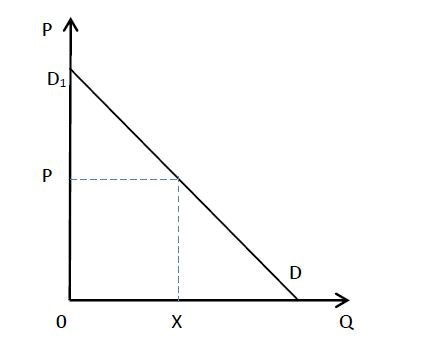

If the firm can negotiate with each buyer individually and sell each unit of output at different prices, which are higher than the equilibrium price, the firm can extract the entire consumer surplus and increase its profit.

This policy is called first-degree price discrimination or as ‘take-it-or-leave-it price discrimination’. (See Figure 1)

This is because in negotiating with each buyer the firm charges the maximum price that the buyer is willing to pay by threatening of denying selling any quantity to him.

First degree price discrimination graph : Figure 1

Second-degree price discrimination

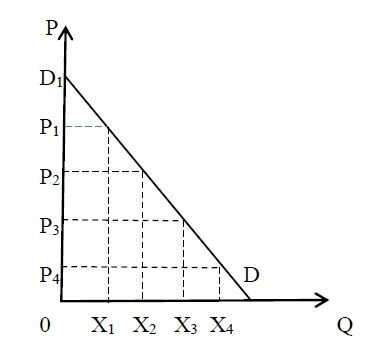

If the firm can negotiate with buyers and sell its output at more than two prices, which is higher than the equilibrium price it can extract still a large part of the consumer surplus and increases its profit. This action is called second-degree price discrimination. (See Figure 2)

Second degree price discrimination graph : Figure 2

Third-degree price discrimination

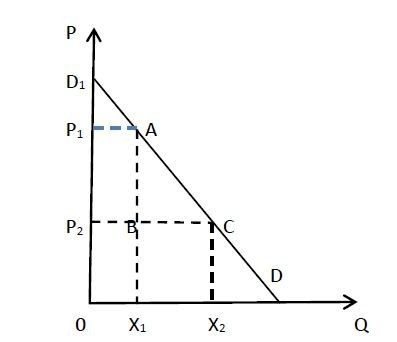

If the firm sells its output in two different markets for two different prices called the ‘third-degree price discrimination’. (See Figure 3)

The equilibrium price is P2 and the firm produces 0-X2 unit of X. Total revenue of the firm is equal to the area of 0P2CX2 and the consumer surplus is equal to the area of P2CD1.

Suppose that the firm decided to sell its output in two markets.

- 0-X1 of X at price P1in the first market

- X1-X2 amount at price P2 in the second market

Now his total revenue is,

0P1AX1 + BCX2X1 = 0P2CX2 + P1P2AB

This indicates that the firm has extracted the part P1P2AB from the consumer surplus as profit.

Third degree price discrimination graph: Figure 3

The monopolist can earn higher revenue as such higher profit through price discrimination than selling all output at a single price. From the buyer’s point of view, they are all subjected to extraction according to their income or purchasing power, or other differences.

An application of Price Discrimination: Dumping as an international price discrimination

Dumping means selling a product in the international market at a lower price than the domestic market. It is international price discrimination.

A producer who produces a product for both domestic and international markets can practice this pricing policy since both markets are separated from each other because of large geographical distance, tariff, quota, etc.

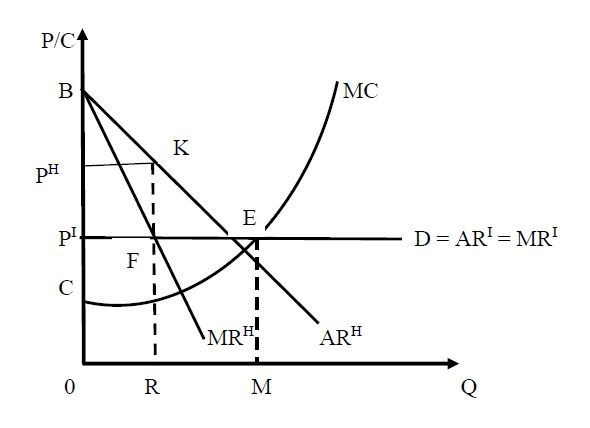

Assume that a producer selling his product in the international market where he faces perfect competition, while in the domestic market as a monopolist.

His demand curve in the international market will be perfectly elastic since he faces perfect competition, while in the domestic market it is sloping downward with less elasticity.

AR and MR curves in the international market coincide with the demand curve. In the home market, his AR curve coincides with the demand curve but MRH lies below the ARH curve. MC is common for both markets. Suppose the price in the international market is PI.

The aggregate demand curve, in this case, is the composite curve BED while MR curve is BFED. The equilibrium point which satisfies MC=MR condition is E and the equilibrium output is M.

The producer distributes this output between two markets to maximize his profit.

It is clear that the marginal cost of the firm at the equilibrium is ME. At point F, MC (=ME) of the firm equals to MR of the home market.

Accordingly OR output will be sold at the home market at price PH which is higher than PI. RM output will be sold in the international market. Join profit of the producer equals to the area CEFB.

The differences of the prices of the two markets are due to the differences of price elasticity of demand. In the domestic market price elasticity is less and charges a higher price while price elasticity of demand in the international market is high and charges the lower price.

Related Topics

Monopolistic Competition and Economic Efficiency

Perfect Competition: Definition, Graphs, short run, long run

Monopolistic Competition Assumptions [Updated]