Inflation can be defined as an increase in the average price level by a certain percentage over a specific time period.

When we talk about a country’s inflation, we mean an increase in the overall price level, not the price of certain goods.

Inflation is likely the world’s second most serious macroeconomic problem today. In developing countries, it ranks second only to hunger and poverty. Inflation is an issue that has occurred since the beginning of the market economy.

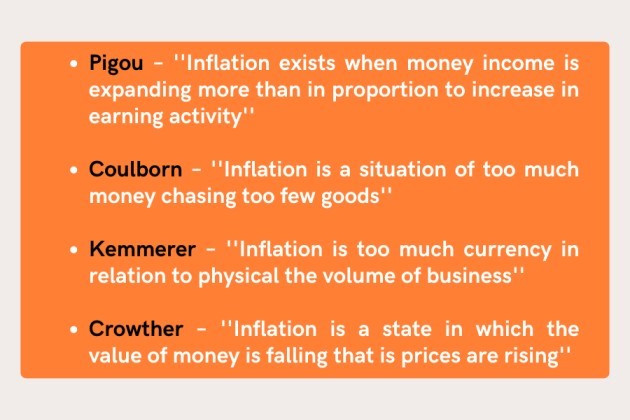

Early Definitions of Inflation

These definitions explain why inflation occurs, but not what inflation is.

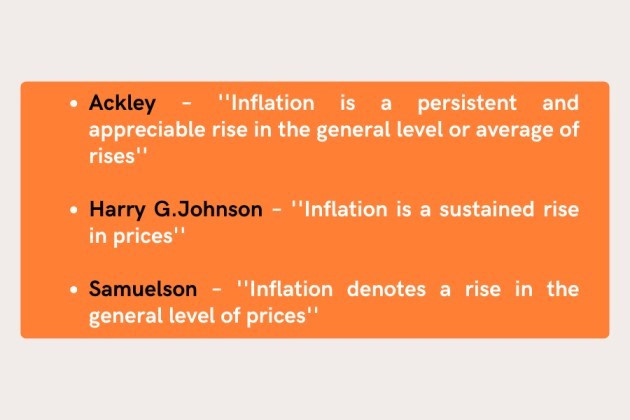

Recent Definitions of Inflation

Inflation, according to these economists, is defined as a steady and noticeable increase in the overall price level.

What Rate of Price Size is Inflation

- Any increase in the overall price level is not considered inflation. Inflation is defined as a significant and appreciable increase in the overall price level over a long period of time.

- Economists are unable to say with certainty whether the rate of price increase is significant or appreciable.

- Inflation is good up to a point. However, over this point, inflation is harmful. As a result, each country must choose its own desired inflation rate.

EVERY PRICE RISE IS NOT AN INFLATION

Every price increase that exceeds a moderate rate is not considered inflation. Price increases for the following causes are not inflationary.

- An increase in price due to a change in the composition of GDP

- A price increase owing to a change in product quality.

- An increase in price as a result of a change in the price indexing system

- Price recovery after the recession

Types of Inflation

Inflation is generally on the basis of its rate and causes. Rate based classification refers to the how high or low is the rate of inflation. Cause based classification of inflation refers to the factors that cause inflation.

Rate Based Inflation

There are 3 types of rate based inflation.

- Moderate inflation

- Galloping inflation

- Hyper inflation

1. Moderate inflation

Moderate inflation, also known as creeping inflation, occurs when the general level of prices increases at a moderate rate over a long period of time.

2. Galloping inflation

Galloping inflation is defined by annual inflation in the double or triple digits of twenty, hundred, or two hundred percent.

Example:

Rate of inflation – 1980/91

Argentina – 416.9 %

Brazil – 327.6 %

3. Hyper inflation

In general, a price rise at more than three-digit rate per annum is called hyper inflation.

Example:

Country – 1989

Argentina – 3079.8%

Brazil – 1287.0%

Cause Based Inflation

There are 2 types of cause based inflation.

1. Demand-Pull inflation

Demand-Pull inflation refers to the rise in the general price level when aggregate demand increase much more rapidly than the aggregate supply.

This is caused by monetary factors and real factors.

Monetary factors

Increase in money supply in excess of increasing potential output.

Real factors

What are the real factors or the non monetary factors,

- Increasing government expenditure in response to tax revenue

- Reduced tax rates with no change in government spending

- An increase in autonomous investment causes the investment function to move higher.

- Export function shifts upward, whereas import function shifts downward.

There are 2 approaches explaining the demand inflation.

- Keynesian analysis

- Arwin pisher analyse (Quantity theory of money)

Keynesian analysis:

Keynesian analysis explain proces od goods and services rises due to the increase in demand. There are 4 factors that affect on demand-pull inflation.

Increace in,

- consumer spending (C)

- investmetn costs (I)

- government expenditure (G)

- net exports (x-m)

Arwin pisher analyse:

According to Arwin-pisher there is a relationship between money supply and price levels.

2. Cost-push inflation

Cost-push inflation is caused by the increase in the cost of production. In other words, cost-push inflation explain increase price of goods and services due to cost.

There are some factors that affect cost -push inflation.

- Increased price of inputs.

- Decrease supply due to natural disasters.

- Taxes on imported inputs.

Is Inflation Good or Bad?

In general, too much inflation is bad for an economy, but too little inflation is also undesirable. Most economists argue for a moderate inflation rate of around 2% a year.

In general, rising inflation is bad for savers because it reduces their buying value. On the other hand, borrowers can make a profit as the inflation-adjusted value of their existing debt decreases over time.

Related Articles