The theory of distribution is also known as the theory of factor pricing. It’s possible that the distribution is functional or personal.

In other words, distribution theory in economics is basically trying to explain the distribution of national income across factors of production such as land, labor, and capital owners.

Normally, economists have examined the costs of these components, as well as the amount to which they provide advantages – rent, wages, and profit.

The Theory of Personal Distribution

Personal distribution refers to how national income is distributed among various factors of production. It is not spread evenly. In general, the top 10% of income recipients receive between 25 and 35 percent of national income, while the bottom 20% of income recipients earn around 5% of national income.

The Theory of Functional Distribution

The functional distribution theory tries to explain the prices of land, labor, and capital.

The factors of production, namely land, labor, capital, entrepreneur, and organization, are paid in the form of rent, wages, interest, profit, and wages. As a result, the theory of functional distribution is also known as the theory of factorial pricing.

Theory of Distribution: Factor Market

To produce goods and services, production factors must be used in the production process. Labor, capital, land, and entrepreneurship are the most important factors.

The first three factors above are exchanged in the factor market, which defines the factor’s equilibrium quantity and price.

Entrepreneurship is a factor that generates businesses and attracts other factors. The majority of factor markets are competitive, meaning there are a large number of buyers and sellers.

Labor Market

Human resources are exchanged on this market. The majority of labor is exchanged on a contract basis, known as a job. However, some work is sold on a daily basis, known as casual labor. Human capital refers to a person’s abilities gained via learning, experience, and training. The wage rate is the cost of labor.

Capital Market

Capital refers to the money used by businesses to purchase and operate their manufacturing processes. People lend and borrow in this market to fund the buying of capital goods. The interest rate is the cost of capital.

Land Market

The land is made up of all of the natural resources that we have been given. Natural gas, water, minerals, and other items were covered.

Factor Pricing under Perfect Competition during Short Period

The following 3 situations are discussed under perfect competition with the help of the diagrams. The firm will be making profit, earning normal profit, and incurring losses.

We suppose that labor is used as a variable factor while all other variables remain fixed.

Profit Making Situation

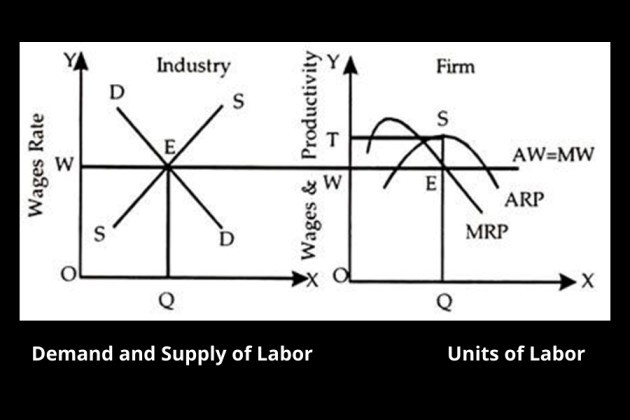

The diagram shows how the industry determines the factor price (wages) based on the entire demand for and supply of labor in the industry.

- DD and SS are the demand curve and supply curve of labor

- E is the point of intersection where OW wage rate is fixed or determined and OQ is the demand and supply of labor as shown on the left portion of the diagram.

- On the right portion of the diagram, the firm employs an OQ of labor with a given wage rate OW.

Unfortunately, the actual world does not have completely competitive labor markets. Labor markets are often monopsonies or contain features of monopsony power in the hands of employers, while factor markets are generally imperfect.

One buyer is referred to as a monopsony. The monopsony model assumes that one company or a group of employers meet, that they buy standardized labor and that the supply side of the market is competitive.

As a result, in this labor market, the monopsonist is a price provider. As a result, the company has a price policy. If the employer wants to hire additional workers, he must boost the salary in order to attract the workers he needs. Therefore, the monopsonist is challenged with an MRC that is to the left of the supply curve and has double the supply curve’s slope.