Qualitative measures in monetary policy play an important role in the development process of the country. Qualitative credit control measures include (1) Prescription of margin requirements (2) Consumer Credit regulations (3) Rationing credit (4) Moral suasion (5) Direct Controls.

- Prescription of margin requirements

- Consumer credit regulations

- Rationing credit

- Moral suasion

- Direct controls

Qualitative measures do not regulate the total amount of credit generated through commercial banks. It only regulates only such credit that creates economic instability.

1. Prescription of margin requirements

The marginal requirement means the difference between the current value of the security offered for a loan and the total loan value granted.

In the case of inflation, the margin requirement is increased so that demand for loans is decreased.

In the case of deflation, margin requirements are deceased so that demand for loans is increased.

When the central bank feels that commodity prices are rising in an economy the speculative activities of businessmen and trades of such goods, the central bank wants to discourage the flow of credit to such speculative activities.

When the central bank feels that the speculative activities of entrepreneurs in the country and the trade-in of those commodities increase the price level of certain commodities, then it increases the marginal need for borrowing for speculative ventures and thus discourages the supply of funds for speculative activities. Then the inflation situation in the country will also be under control.

The Central Bank can also encourage borrowing from commercial banks by reducing the margin requirement demand of another country.

When there is a greater flow of credit to different business activities, investment is increased. Income of the people rises.

Thus marginal requirement can be cited as an important tool of the central bank to control inflation and deflation.

2. Consumer Credit regulations

In this instrument, consumer credit supply is regulated through the sale and rental of consumer goods. Today, many durable consumer goods, such as computers, washing machines, T.V. are available on a premium basis using bank credit.

Loans made by commercial banks to purchase such durable consumer goods are called consumer credit.

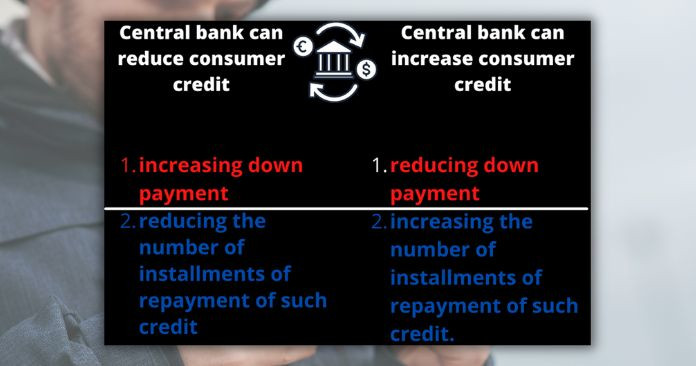

In some cases, when there is a high demand for durable consumer goods, their price level also rises. The central bank can reduce consumer credit in two ways.

- Increasing down payment

- Reducing the number of installments of repayment of such credit.

Also when the demand for certain commodities decreases, it leads to deflation. The central bank can increase consumer credit in two ways.

- Reducing down payment

- Increasing the number of installments of repayment of such credit.

3. Rationing of Credit: Qualitative Measures of Monetary Policy

Qualitative measures in monetary policy also include the rationing of credit. Allocation of loans for each business is called rationing of credit. This is introduced when the flow of credit is to be checked particularly for speculative activities in the economy.

4. Moral suasion

This has no legal backing. Moral suasion is a policy tool frequently used by the Central Bank to obtain commercial banks in line with its broader objectives.

There exists a cordial and harmonious relationship between the Central Bank and commercial banks. So an opportunity exists for the former to persuade the latter to adopt practices and policies that are conducive to the implementation of ongoing programs of the central bank and of the government.

One of the areas where the central Bank used moral suasion to a significant extent was in the implementation of the National Credit Plan (NCP) under which the Banks’ annual monetary program was combined with a diversion of commercial bank credit to pre-determined priority areas.

This enabled the Central bank to allocate a significant amount of bank credit to vital sectors in the economy. So commercial banks benefitted from the improved management environment emanating from the system of corporate planning they were required to carry out under this scheme.

5. Direct Controls: Qualitative Measures of Monetary Policy

The direct controls exercised by the Central Bank to regulate money and credit are designed to achieve their intended purpose by imposing an effective restraint on the final output of commercial

banks.

Thus, these measures help the authorities to bring the credit markets back to order by creating a “shock effect” in banks when the conventional market-oriented policy measures fail to arrest an expanding monetary situation.

Hence, it is of utmost importance that the authorities resort to direct control measures as sparingly as possible. Only under extraordinary circumstances that warrant swift action on their part, and then shift the emphasis of policy back to market-oriented policies as quickly as possible.

The following direct control methods are frequently adopted by the Central Bank to regulate money and credit.

- Selective Credit Controls

- Cash Margins against Letters of Credit

Selective Credit Controls

Selective credit controls (SCC), take the form of discriminatory application of direct controls. They are basically intended to,

- Alleviate adverse repercussions of restrictive monetary policy measures.

- Cause a forced allocation of resources to pre-determined sectors by influencing the lending policy of banks.

Traditional methods of monetary control affect all the sectors without discrimination. The SCC affects specific economic activities. For example, helping authorities to achieve specified objectives such as discouraging consumption, speculative types of imports, etc.

Under the SCC, the Central Bank has the power to correct the advance and deposits of commercial banks and to determine the maximum allowable maturity for loans.

Cash Margins against Letters of Credit

The central bank can impose specify different cash margins for different kinds of transactions.

Most often, the authorities select luxury or non-essential items when specifying such cash margins. So any adverse impact on the consumers could be kept at a minimum.