What Is Net Foreign Factor Income (NFFI)?

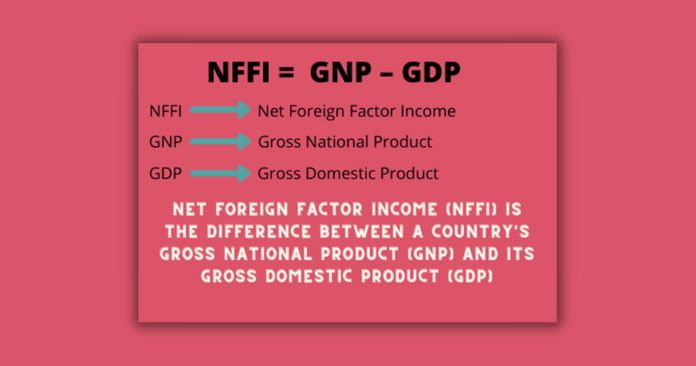

Net foreign factor income (NFFI) is the difference between a country’s gross national product (GNP) and its gross domestic product (GDP).

In another word, Net foreign factor income is the difference between the aggregate amount that a country’s citizens and companies earn abroad, and the aggregate amount that foreign citizens and overseas companies earn in that country.

How is NFFI calculated?

Net Foreign Factor Income = gross national product – gross domestic product

NFFI = GNP – GDP

Gross National Product

Gross national product is the aggregate market value of all goods and services produced by all of its citizens and businesses irrespective of their location (local or global) during a particular period.

Essentially, GNP acts as a superset of GDP, as it factors in the net income from abroad in addition to the GDP.

Gross national product = gross domestic product + Net Foreign Factor Income

GNP = GDP + NFFI

Gross National Product can also be calculated as follows:

GNP = GDP + Net Income Inflow from Oversees – Net Income Outflow to Foreign Countries

Gross Domestic Product

Gross domestic product is the best way to measure a country’s economy. GDP is the total value of everything produced by all the people and companies in the country.

It doesn’t matter if they are citizens or foreign-owned companies. If they are located within the country’s boundaries, the government counts their production as GDP.

Gross domestic product = Gross domestic product – Net Foreign Factor Income

GDP = GNP – NFFI

What is the difference between GNP and GDP

- GDP is within the geographical area demarcated by the borders of a country.

- GNP extends to other countries/regions for activities performed and net income generated by its nationals.

- GDP measures the monetary value of a country within the country’s boundary.

- GNP additionally includes it for the enterprises/activities owned/operated/performed by the residents of the country (local + global).

- GDP is the strength of the country’s local economy.

- GDP shows how its nationals contribute to the country’s economy.

- GDP is based on location

- GNP is based on citizenship

- Higher GNP than GDP indicates that citizens of a country are doing better abroad.

- If an economy were closed, then GNP = GDP

Components of Net Foreign Factor Income

- Net compensation of employees

- Net income from property and entrepreneurship

- Net retained earnings of resident companies abroad

Net compensation of employees

This means the difference between the income earned by a resident worker living or working in a foreign country and the same payment made by a non-resident employee who stays or is employed in the domestic territory.

Net income from property and entrepreneurship

This means the difference between income from property and entrepreneurship (rent, interest, profit) received by residents of the country and similar payments made to the non-residents.

Net retained earnings of resident companies abroad

This means the difference between retained earnings of resident companies located foreign country and retained earnings of the non-resident company located within the domestic territory of the country.

Rate the article if you learned something new from it.

⭐⭐⭐⭐⭐