Balance of Payments Definition: Balance of Payments records a country’s value of the transactions between its residents, businesses, and government with the rest of the world for a specific period of time. BOP provides useful information about international flows.

It reports the country’s international performance in trading with other nations. BOP considers as a list of items behind the supply and demand for a currency.

Major Accounts of Balance of Payment

There are three major BOP accounts:

- Current account

- Capital and Financial account

- Official reserves account

Balance of Payments Definition: Current Account

The current account records the followings:

- Goods and services transactions (imports and exports)

- Transaction associated with income flows from the ownership of foreign assets (dividend and interest)

- Income from labors

- Unilateral transfers of money (foreign aids, gifts, donations, and grants)

Balance of Payments Definition: Capital and Financial Account

1. Capital and financial account transactions affect a nation’s wealth and net creditor position.

2. Transactions are classified as:

- Portfolio investment: purchase financial assets with a maturing greater than one year, foreign shares, and bonds that do not involve acquisitions of control.

- Short term investment: involve securities with a maturity of less than one year.

- Direct investment involves acquisitions of controlling interests in foreign businesses.

- Other investment includes bank deposits, currency investment, and trade credit.

3. Capital and financial account records:

- Purchase and sale of foreign assets by domestic residents

- Purchase and sale of domestic assets by foreign residents

Assets:

Financial assets (bank deposits and loans, bonds, and equities)

Real assets (factories, real estate, antiques)

Balance of Payments Definition: Reserves Account

- It measures a country’s surplus or deficit on its current and capital account transactions.

- Surplus leads to an increase in official holdings.

- Deficit causes a reduction in official holdings.

- International reserve transactions are recorded in the Official Reserve Account.

- International reserves are the assets of the Central Bank. They are not denominated in the domestic currency.

- Due to BOP deficit, the country could either run down its official reserve or borrow new from foreigners.

Double-Entry Accounting System in Balance of Payments

1. Similar to the financial accounting system

2. Debit transaction

- Transactions resulting in a payment to foreigners

- Outflows or uses of foreign exchange

- Listed with a negative (-) sign

- Increase the demand for foreign currency

3. Credit transaction

- Transactions resulting in a receipt of funds from foreigners

- Inflows or sources of foreign exchange

- Listed with a positive (+) sign

- Increase the supply of foreign currency

Balance of Payment Entries

| Account | Credit | Debit |

| Current transaction | Export of goods Export of services Factor income received Unilateral income transfers IN | Import of goods Import of services Factor income paid Unilateral transfers OUT |

| Capital and financial transaction | Unilateral assets transfers IN Private sales of assets Inward FDI Share, Bond sold Other asset sold Central bank’s sales of assets | Unilateral assets transfers OUT Private purchases of assets Outward FDI Share, Bond brought Other asset brought Central bank’s purchase of assets |

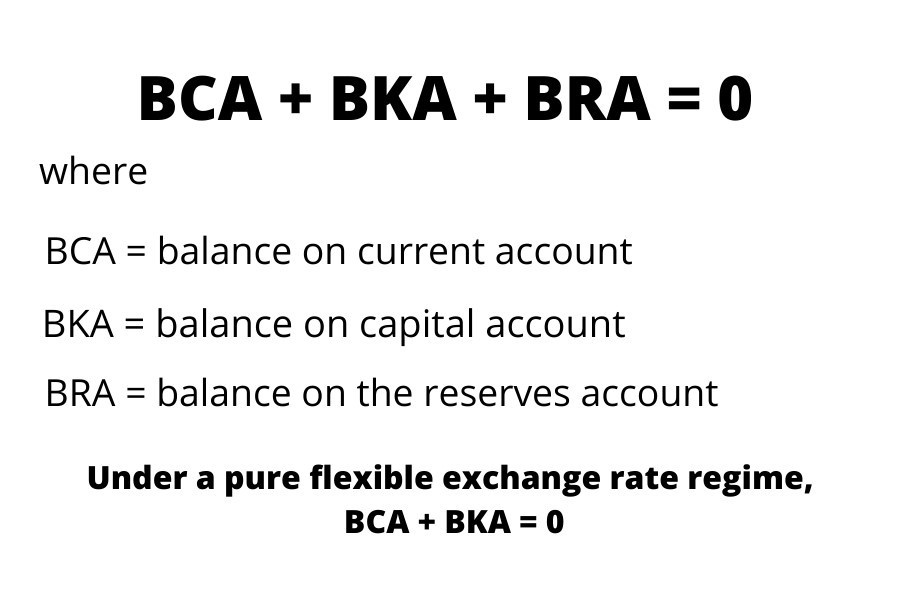

The Balance of Payments Identity

Under a pure flexible exchange rate regime, current account balance and the capital account would equal each other

However, in the real world, there is a statistical discrepancy (omissions and mis-recorded transactions)

Surplus and Deficit in the Balance of Payments

- Although the totals of payments and receipts are necessarily equal, there will be inequalities.

excesses of payments or receipts, called deficits or surpluses

- Surplus – credit transactions are greater than debit transactions.

- Deficit – debit transactions are greater than credit transactions.

- The current account and the capital account add up to the total account, which is necessarily balanced, a deficit in the current account is always accompanied by an equal surplus in the capital account and vice versa.

Current account deficit = Capital account surplus.

- A deficit or surplus in the current account cannot be explained or evaluated without a simultaneous explanation and evaluation of an equal surplus or deficit in the capital account.

- The effects of a change in one of these factors on the current account balance cannot be predicted without considering the other causal factors.

For example,

if a country increases tariffs, people will buy fewer imports

reducing the current account deficit.

This reduction will occur only if one of the other factors changes to decrease the capital account surplus.

Current account deficit/surplus

The current account deficit can be financed by:

- Selling country’s treasury bills, bonds, stocks, or real estates

- Selling off previous investments in foreign treasury bills, bonds, stocks, or real estates

Current account surplus can be invested:

- In foreign treasury bills, bonds, stocks, or real estates

- Factors affecting foreign investments

- Interest rate (rate of return) in the foreign country vs domestic

- The riskiness of the investment

Link between current and capital accounts

National income/ product = Consumption + Savings

National Spending = Consumption + Investment

Nat. income – Nat. spending = Savings – Investment

Nat. income – Nat. spending = Exports – Imports

Savings – Investment = Exports – Imports

Net Foreign Investment = Export – Import

Current account surplus – country is a net exporter of capital

Current account deficit – country is a net capital importer

The implication of Balance of Payments account identity

When considering the implication of the BOP account identity for fixed and flexible exchange rates,

1. With the flexible exchange rate

- Measure current account deficit /surplus equals correctly measure capital account surplus/deficit.

2. With the fixed exchange rate

- Reserves of foreign and domestic currency increase/decrease equal current and capital accounts surplus/deficit.

The implication of Balance of Payments with a fixed exchange rate

- Official reserves change = combined current and capital account deficit/surplus

- The country has a combined deficit in current and capital account

- The Government needs to supply foreign currency to keep the exchange rate fixed

- Use official reserves (fall down)

- To increase official reserves government borrows from abroad

- Interest payment for borrowings

- More future current account deficits

Balance of Payments and Economic Policy

- The objective of economic policy is to have balanced trade over long-period.

- A country should have a temporary trade deficit or trade surplus.

- The temporary trade surplus – the country can increase foreign assets.

- The income of foreign assets helps to overcome temporary trade deficit in the future (without borrowing abroad).

Conclusion

All right then. I really hope you learned this article.

Have you a question about something that I covered.

Either way, I’d like to hear from you. So go ahead and leave a comment below.